[Ultimate Guide] Where to Buy Mortgage Leads Online?

Description: |

|

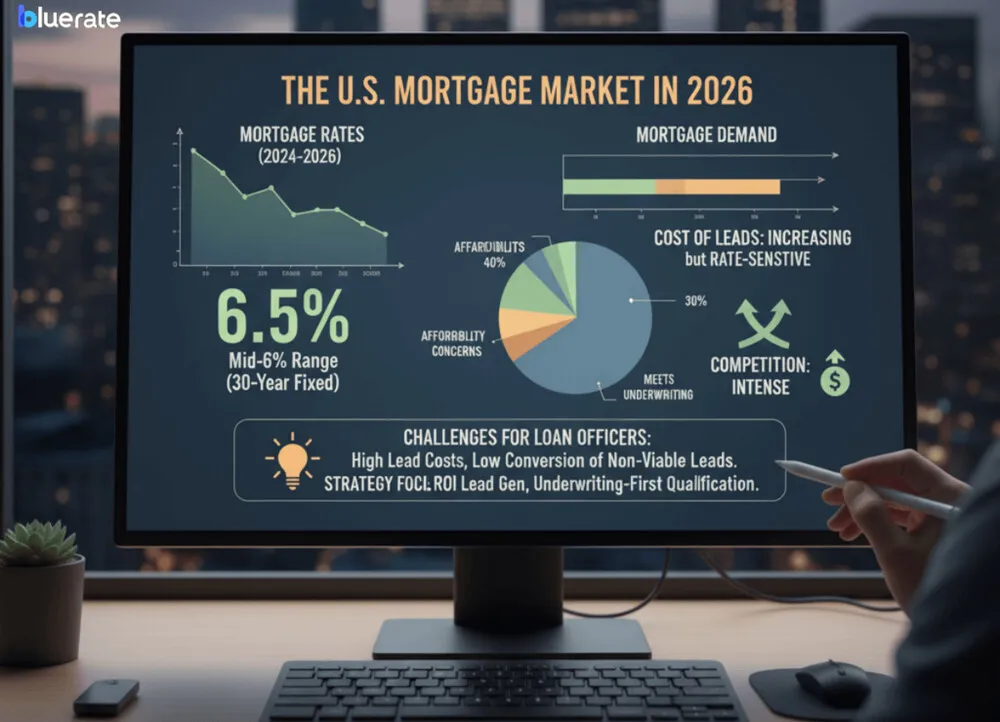

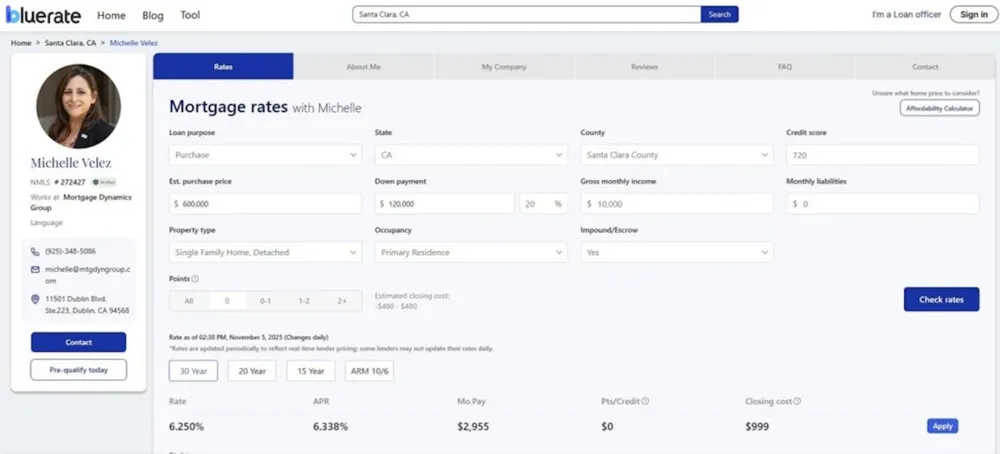

| As a loan officer with over a decade of experience, I know how challenging it can be to find high-quality mortgage leads. When I first started, I struggled to consistently connect with serious borrowers. Like many of you, I've tried everything from cold calling to purchasing expensive lead lists with mixed results. Through years of testing different approaches, I've discovered several reliable methods to acquire qualified mortgage leads online. In this guide, I'll share the strategies that actually work in today's competitive market, including my personal favorite platform that has transformed how I generate business. The U.S. Mortgage Market in 2026 The U.S. mortgage landscape in 2025-2026 continues to present both challenges and opportunities for loan officers. According to recent industry analysis, mortgage rates have drifted down from their 2024-early 2025 peaks, commonly sitting in the mid-6% range for 30-year fixed loans. While this marks an improvement from earlier highs, rates remain above historic lows, creating ongoing affordability concerns for many potential borrowers. Demand has stabilized somewhat after a period of weak applications, but the market has become increasingly sensitive to rate movements. For loan officers, this environment creates significant challenges in lead generation. The cost of acquiring qualified leads has increased as competition intensifies for a smaller pool of price-sensitive borrowers. Many potential borrowers either cannot meet strict underwriting criteria or struggle to afford monthly payments at current rate levels, reducing the volume of viable leads. Understanding these market dynamics is crucial for developing effective lead generation strategies that deliver ROI in today's climate. Best Ways to Buy Mortgage Leads Online Here are some common online ways that you can consider giving it a try. Organic Traffic In my experience, organic traffic generates the highest-quality mortgage leads because these prospects are actively searching for solutions. Unlike purchased leads, visitors who find you through search engines demonstrate genuine intent and often convert at higher rates. That's why I recommend Bluerate, an AI-powered mortgage marketplace developed by Zeitro. This platform allows loan officers to create professional profile pages optimized for search visibility. What sets Bluerate apart is its comprehensive approach to lead generation and loan processing. Instead of just generating leads, it helps you convert them more efficiently. Key Features That Won Me Over: - Streamlined Loan Origination: Bluerate integrates with your LOS, making the entire origination process more transparent and efficient. I've personally closed 30% more loans and completed them up to 20% faster since implementing their system. - AI-Powered Guidance: The platform includes GuidelineGPT and Scenario AI that provide instant, accurate answers based on current mortgage guidelines. This has eliminated 100% of my manual guideline research, saving me over 7 hours per loan file. - Accelerated Pre-qualifications: Borrowers can pre-qualify online, complete the 1003 form effortlessly, and export data in FNM 3.4 format. This has helped me deliver 2.5x faster pre-qualifications. - Automated Document Processing: The system automatically organizes and extracts data from borrower documents like income statements and tax returns, ensuring everything is prepared for underwriters. - Instant DTI Calculation: Bluerate automatically pulls borrower financial data and calculates Debt-to-Income ratios accurately using AI. - Automated Form Generation: The platform automatically generates 1003 forms while minimizing errors and manual input, and allows you to run instant credit checks for accurate pre-approval results. The best part? You can create your profile page for free and start attracting warm leads through organic search. I've also used my Bluerate page as a landing page for paid campaigns, which significantly improves ad ROI compared to generic landing pages. Google Search Ads Google Search Ads remain one of the most effective ways to reach high-intent borrowers actively searching for mortgage solutions. Based on my experience and industry data, properly optimized search campaigns can achieve conversion rates between 1% to 5% for initial contact. The key advantage of Google Ads is targeting users with demonstrated interest. People searching for terms like "mortgage rates," "first-time home buyer program," or "refinance options." These prospects are further along in the decision-making process, which typically results in higher-quality leads. However, competition has driven up costs significantly. In competitive markets, cost-per-lead can range from $20 to $100+, depending on targeting and geographic competition. The ROI can be substantial, though well-optimized campaigns with fast follow-up can deliver 2x to 4x returns on ad spend. To maximize results, I create highly specific ad groups targeting different borrower segments like purchase, refinance, FHA, and VA, and use ad extensions to highlight my unique value propositions. Most importantly, I ensure my landing pages are optimized for conversion with clear calls-to-action and mobile-responsive design. Facebook/Instagram Social media platforms like Facebook and Instagram offer powerful targeting options for mortgage lead generation, though they work best for building brand awareness and capturing early-stage interest rather than immediate conversions. In my campaigns, I've found that Facebook and Instagram ads typically generate conversion rates between 1% to 3%, with costs per lead ranging from $30 to $80 depending on targeting specificity. The visual nature of these platforms makes them ideal for showcasing customer testimonials, educational content, and neighborhood highlights. The real strength of social media advertising lies in sophisticated targeting capabilities. I've successfully targeted users by life events like newly married, and recently changed jobs, interests like first-time home buyer groups and real estate investing, and geographic criteria. Lookalike audiences based on my existing customers have performed particularly well. Retargeting website visitors through Facebook and Instagram has also been crucial for my conversion strategy. Prospects who engaged with my content but didn't convert initially often need multiple touchpoints before committing. With proper nurturing, social media leads can deliver a solid ROI between 2x to 4x. While often overlooked for mortgage lead generation, LinkedIn has become my secret weapon for reaching specific professional segments, particularly self-employed borrowers and real estate investors. The platform's professional context and precise targeting by industry, company size, and job function make it ideal for connecting with borrowers who have complex financial situations. I've found LinkedIn leads typically have higher loan amounts and more sophisticated needs, justifying the higher acquisition cost. Conversion rates on LinkedIn tend to be slightly lower than on other platforms, typically 1% to 2% in my experience, but the lead quality is significantly higher. Cost per lead generally ranges from $75 to $150+, reflecting the more valuable audience. My most successful LinkedIn approach has been creating content that addresses specific professional concerns, including articles about mortgage strategies for business owners, videos explaining debt-to-income considerations for commission-based earners, and guides to investment property financing. These content pieces position me as an expert in serving professional borrowers, leading to more qualified inquiries. With proper targeting and relevant messaging, LinkedIn campaigns can deliver ROI between 3x to 5x for the right loan officers, particularly those specializing in jumbo loans or professional segments. How Much for a Mortgage Lead? Based on my experience and industry data, mortgage lead costs vary significantly based on type, quality, and exclusivity. Here's what you can expect to pay in today's market: Basic, non-exclusive leads typically cost between $20 to $40 per lead. These are often shared with multiple lenders and require quick follow-up. Qualified or high-detail leads with more complete information generally range from $20 to $100 each. These include additional data like credit score ranges, income verification, and property details. Exclusive, high-intent leads, including those for jumbo loans or niche programs, command premium prices, frequently $100 to $200+ per lead. These are not shared with competitors and have higher conversion potential. Remember that lead cost should be evaluated alongside conversion rate and average loan size to determine true ROI. A higher-cost lead that converts reliably may deliver better returns than cheaper alternatives. ROI of Mortgage Leads Calculating accurate ROI for mortgage leads requires looking beyond initial cost per lead to consider the entire conversion funnel. Based on my tracking across multiple channels, the ROI varies significantly by source and lead quality. High-intent, exclusive leads with strong nurturing can deliver impressive returns—5x to 10x or higher in well-optimized campaigns. These leads typically come from referral partnerships, organic search, and targeted paid campaigns. For broader lead sources like non-exclusive purchased leads or general digital advertising, expect more modest returns, typically in the 2x to 4x range. These require more intensive follow-up and have lower conversion rates. The most important factor in maximizing ROI is the speed of follow-up. Leads contacted within 5 minutes of inquiry are significantly more likely to convert than those reached even 30 minutes later. Implementing automated yet personalized immediate response systems has been the single biggest factor in improving my lead ROI across all channels. Also consider that ROI isn't just about immediate conversion. Some leads that don't close immediately can become valuable prospects months later when their situation changes. Proper nurturing systems ensure you capture this long-term value. Conclusion Generating quality mortgage leads in today's competitive market requires a diversified approach combining both organic and paid strategies. While Google Ads, social media, and LinkedIn all have their place in a comprehensive lead generation strategy, I've found that organic traffic consistently delivers the most sustainable, cost-effective results. That's why Bluerate remains my top recommendation for loan officers seeking to improve their lead quality and conversion rates. The platform's AI-powered tools not only help you attract more qualified leads but also significantly reduce the time and effort required to convert them. The ability to create a professional, search-optimized profile for free provides immediate value, while the advanced features can transform your entire loan origination process. In a market where every advantage counts, having the right technology partner can make the difference between struggling to find leads and building a thriving, sustainable business. The strategies I've shared here have worked for me, and I'm confident they can help you navigate today's challenging mortgage landscape more effectively. |

|

Members profile: |

|

| Advertised by: | Lori Naranjo (click here to see full profile) |

| Email: | Email Advertiser |

Ad Details |

|

| Garage Spaces (put 0 if this does not apply) | 0.00 |

| Price: | $0 USD |

Website |

|

| Website | https://www.bluerate.ai |

| Website | https://www.zeitro.com |

Call Me! |

|

| Phone | 650-540-1500 |

| Ad id: | 13155143 |

| Views: | 3102 |